Easy Accounting Definitions of Debit and Credit

Image source: Getty Images

If you're using double-entry accounting, you need to know when to debit and when to credit your accounts. We'll help guide you through the process, and give you a handy reference chart to use.

Debits and credits are two of the most important accounting terms you need to understand. This is particularly important for bookkeepers and accountants using double-entry accounting.

Debits and credits are the true backbone of accounting, as any transaction recorded in a ledger, whether it's hand-written or in your accounting software, needs to have a debit entry and a credit entry.

But how do you know when to debit an account, and when to credit an account? The following basic accounting rules will guide you.

What are debits and credits?

As a business owner, you may find yourself struggling with when to use a debit and credit in accounting. You may even be wondering why they're even necessary.

Debits and credits are used to ensure that you're adhering to the accounting equation, which is:

Assets = Liabilities + Equity

In double-entry accounting, any transaction recorded involves at least two accounts, with one account debited while the other is credited. Debits are always on the left side of the entry, while credits are always on the right side, and your debits and credits should always equal each other in order for your accounts to remain in balance.

For instance, if we were to record a $250 payment received on account from a customer, the journal entry for debits and credits would look like this:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 2/28/2020 | Cash | $250 | |

| 2/28/2020 | Accounts Receivable | $250 |

In this journal entry, cash is increased (debited) and accounts receivable credited (decreased).

Working from the rules established in the debits and credits chart below, we used a debit to record the money paid by your customer. A debit is always used to increase the balance of an asset account, and the cash account is an asset account. Since we deposited funds in the amount of $250, we increased the balance in the cash account with a debit of $250.

In the second part of the transaction, you'll want to credit your accounts receivable account because your customer paid their bill, an action that reduces the accounts receivable balance. Again, according to the chart below, when we want to decrease an asset account balance, we use a credit, which is why this transaction shows a credit of $250.

| Account Type | Increases Balance | Decreases Balance |

|---|---|---|

| Assets: Assets are things you own such as cash, accounts receivable, bank accounts, furniture, and computers | Debit | Credit |

| Liabilities: Liabilities include things you owe such as accounts payable, notes payable, and bank loans | Credit | Debit |

| Revenue: Revenue is the money your business is paid for the sale of products and services | Credit | Debit |

| Expenses: Expenses are considered the cost of doing business and include things such as office supplies, insurance, rent, payroll expenses, and postage | Debit | Credit |

| Capital/Owner Equity: The Capital/Owner Equity account represents your financial interest in the business | Credit | Debit |

Debit vs credit: What's the difference?

Debits: A debit is an accounting transaction that increases either an asset account like cash or an expense account like utility expense. Debits are always entered on the left side of a journal entry.

Credits: A credit is an accounting transaction that increases a liability account such as loans payable, or an equity account such as capital. A credit is always entered on the right side of a journal entry.

If you're unsure when to debit and when to credit an account, check out our t-chart below.

Debit and credit accounts

| Account | When to Debit | When to Credit |

|---|---|---|

| Cash and bank accounts | When depositing funds or a customer makes a payment | When bills are paid |

| Accounts receivable | When a sale is made on credit | When the customer pays |

| Various expense accounts such as rent, utilities, payroll, and office supplies | When a purchase is made or a bill paid | When a refund is received |

| Accounts payable | When a bill is paid | When entering a bill for future payment |

| Revenue | When a product is returned, or a discount is given | When a sale is made |

Examples of debits and credits in double-entry accounting

Here are a few examples of common journal entries made during the course of business.

Recording a sales transaction

Recording a sales transaction is more detailed than many other journal entries because you need to track cost of goods sold as well as any sales tax charged to your customer.

For example, on February 1, your company sells five leather journals at a cost of $20 each. After 7% sales tax, the customer is invoiced for $107.00. Here is how you would record these debits and credits in a journal entry:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 2-1-2020 | Accounts Receivable | $107 | |

| 2-1-2020 | Cost of Goods Sold | $ 55 | |

| 2-1-2020 | Revenue | $100 | |

| 2-1-2020 | Inventory | $ 55 | |

| 2-1-2020 | Sales Tax Payable | $ 7 |

You will increase (debit) your accounts receivable balance by the invoice total of $107, with the revenue recognized when the transaction takes place. Cost of goods sold is an expense account, which should also be increased (debited) by the amount the leather journals cost you.

Revenue will be increased (credited) by $100.

The inventory account, which is an asset account, is reduced (credited) by $55, since five journals were sold.

Finally, you will record any sales tax due as a credit, increasing the balance of that liability account.

Recording a business loan

On January 1, 2020, your business receives a loan in the amount of $25,000, with a 5% interest rate, paid annually. The note is due December 31, 2022. Here is how you record it:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 1-1-2020 | Cash | $25,000 | |

| 1-1-2020 | Notes Payable | $25,000 | |

| 1-1-2020 | Interest Expense | $625 | |

| 1-1-2020 | Interest Payable | $625 |

Make a debit entry (increase) to cash, while crediting the loan as notes or loans payable. You will also need to record the interest expense for the year.

When you pay the interest in December, you would debit the interest payable account and credit the cash account.

Recording a bill in accounts payable

When you receive a bill from a supplier or a utility company, you'll enter it into accounts payable, since the bill will be paid in the near future. The entry would look like this:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 2-1-2020 | Utility Expense | $203 | |

| 2-1-2020 | Accounts Payable | $203 |

You would debit (increase) your utility expense account, while also crediting (increasing) your accounts payable account.

Recording payment of a bill

When you pay the utility bill the following month, the entry would look like this:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 2-28-2020 | Accounts Payable | $203 | |

| 2-28-2020 | Cash | $203 |

You would debit (reduce) accounts payable, since you're paying the bill. You would also credit (reduce) cash.

Best accounting software to track debits and credits

General ledger accounting is a necessity for your business, no matter its size. If you want help tracking assets and liabilities properly, the best solution is to use accounting software. Here are a few choices that are particularly well suited for smaller businesses.

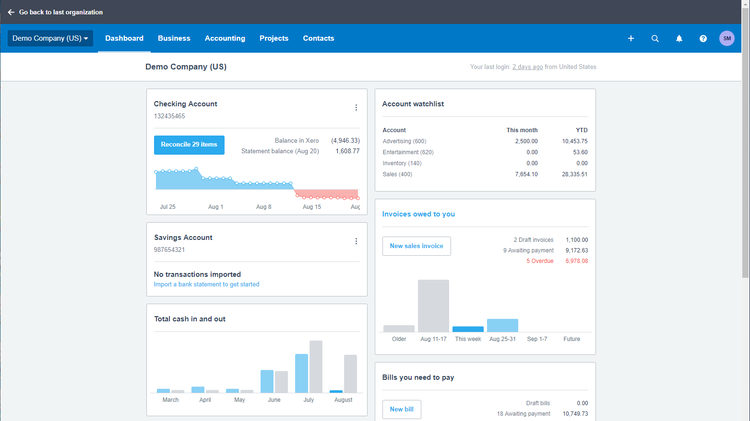

1. Xero

Xero is an easy-to-use online accounting application designed for small businesses. Xero offers a long list of features including invoicing, expense management, inventory management, and bill payment.

The dashboard in Xero offers a summary of current account activity. Image source: Author

Xero offers double-entry accounting, as well as the option to enter journal entries. Reporting options are also good in Xero, and the application offers integration with more than 700 third-party apps, which can be incredibly useful for small businesses on a budget.

Xero offers three plans: Early, Growing, and Established, with the Early plan currently $9/month; Growing is currently $30/month; while Established is $40/month, with a 30-day free trial available.

2. Sage Business Cloud Accounting

Best suited for very small businesses, Sage Business Cloud Accounting is also a good choice for freelancers and sole proprietors who want to manage business finances properly.

Sage Business Cloud Accounting's Sales Summary page offers an overview of sales activity. Image source: Author

Sage Business Cloud Accounting offers double-entry accounting capability, as well as solid income and expense tracking. Reporting options are fair in the application, but customization options are limited to exporting to a CSV file.

Sage Business Cloud Accounting offers two plans: Accounting Start and Accounting, with Accounting Start only suitable for very small businesses. Accounting Start is $10/month, while Accounting is currently $25/month, with both plans offering invoicing, tracking, and bank connectivity.

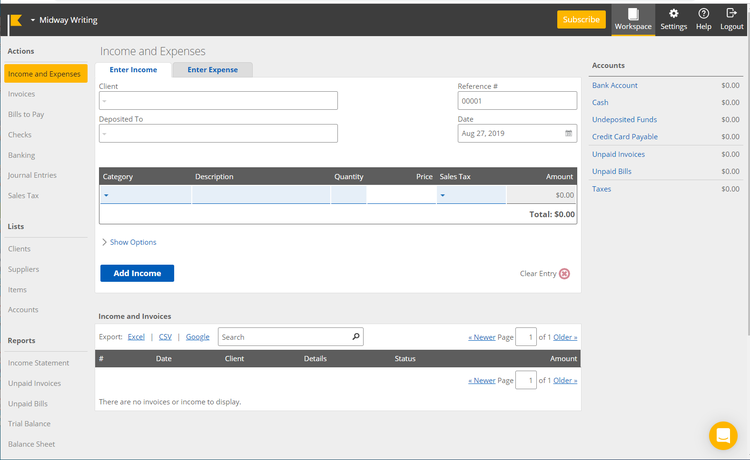

3. Kashoo

Kashoo is an online accounting software application ideally suited for start-ups, freelancers, and small businesses.

Kashoo offers good income and expense management capability. Image source: Author

Kashoo offers a surprisingly sophisticated journal entry feature, which allows you to post any necessary journal entries. Reporting options are limited to financial statements and a couple of list reports, with few customization options available, though reports can be exported to Microsoft Excel if customization is desired.

Kashoo offers a single plan for all subscribers, with the plan running $199/year, or $19.95/month, and supports an unlimited number of users.

Debits vs. credits: A final word

Whether you're creating a business budget or tracking your accounts receivable turnover, you need to use debits and credits properly.

In fact, the accuracy of everything from your net income to your accounting ratios depends on properly entering debits and credits. Taking the time to understand them now will save you a lot of time and extra work down the road.

Source: https://www.fool.com/the-ascent/small-business/accounting/articles/debit-vs-credit/

0 Response to "Easy Accounting Definitions of Debit and Credit"

Post a Comment